Get Free Trial Week Developer Access, Try Before You Hire. Click Here to Claim Now

Customer:

Prominent in the financial sector, who is looking for a modern solution to simplify and enhance their credit loan application process, ensuring accuracy and data security for their clients.

Challenge to Create Loan Tracking Platform

One of the leading financial institutions regularly faced challenges in efficiently managing their credit loan application process. The existing Loan Management System was complex, with many issues such as significant errors, lack of transparency, etc. The client's customers often complained about the existing lengthy Loan Management App process. Also, Loan Tracking Software made it difficult for the client to manage and verify the applications by reviewing the documentation and assessing the eligibility. The client then requested help with a modern solution like Customer Relationship Management Software that helps overcome all the existing issues and streamline everything smoothly.

- Security Challenge: We used multiple kinds of authentication, like two-factor authentication and Google Authenticator. We must keep banking data secure, so we used encryption methods like SHA-1 to SHA-256. Before uploading an image or docs, we need to scan the document so that the user can not be able to upload a virus file.

- The CRM Software will have multiple roles for Due Diligence, Extended Due Diligence, and Credit Applications, but only a desired role can change the data. For every step of essential data, all the associated roles will get the mail as per the data modification.

Loan Tracking System Solution Implemented By Our Team

To address the challenges faced by the client, our dedicated developer team has proposed a solution to develop a credit loan management system. The Loan Management system aims to simplify the entire credit loan application process while ensuring data accuracy and security.

Key Features:

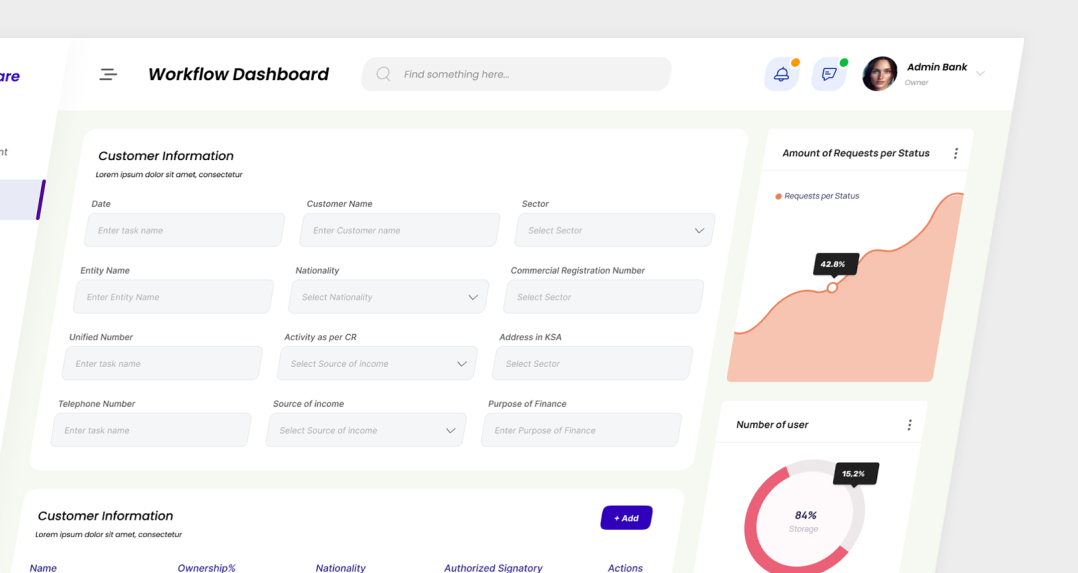

- Customer Portal: Provides secure customer login and allows customers to undergo quick and user-friendly loan application submission.

- Document Verification: Automated document verification using AI and OCR technology. Enabling real-time status updates for document verification.

- Eligibility Assessment: Advanced algorithms to assess customer eligibility based on credit history and financial details. Provides instant eligibility results.

- Loan Selection: Customers can view detailed loan types and terms information. Loan comparison tool that helps the customer to choose the best option from all the available options.

- Eligibility Criteria: To be eligible for the Loan, the user must undergo different steps like Financial spreading, Scoring, and Due Diligence. Financial spreading will help the banks analyse borrowers by reviewing their financial statements. The bank will then check the financial score of the company based on a few criteria.

- Two-Step Data Verification: Ensures data accuracy and security at every stage. This helps reduce the risk of errors and fraud.

- Payment Management: Automated loan disbursement to approved applicants' accounts. Provides seamless integration with auto-deduct accounts for repayment.

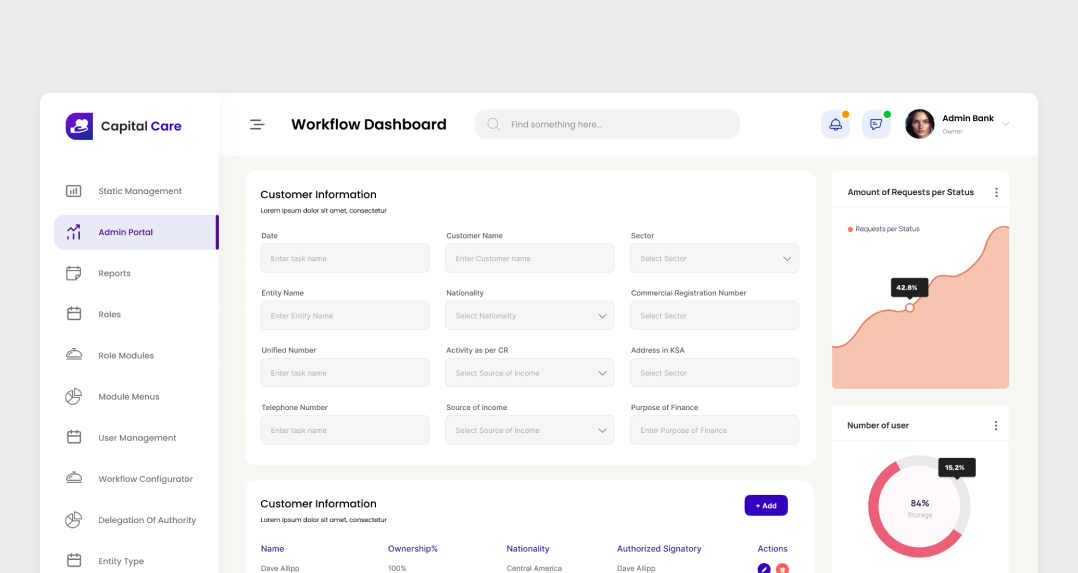

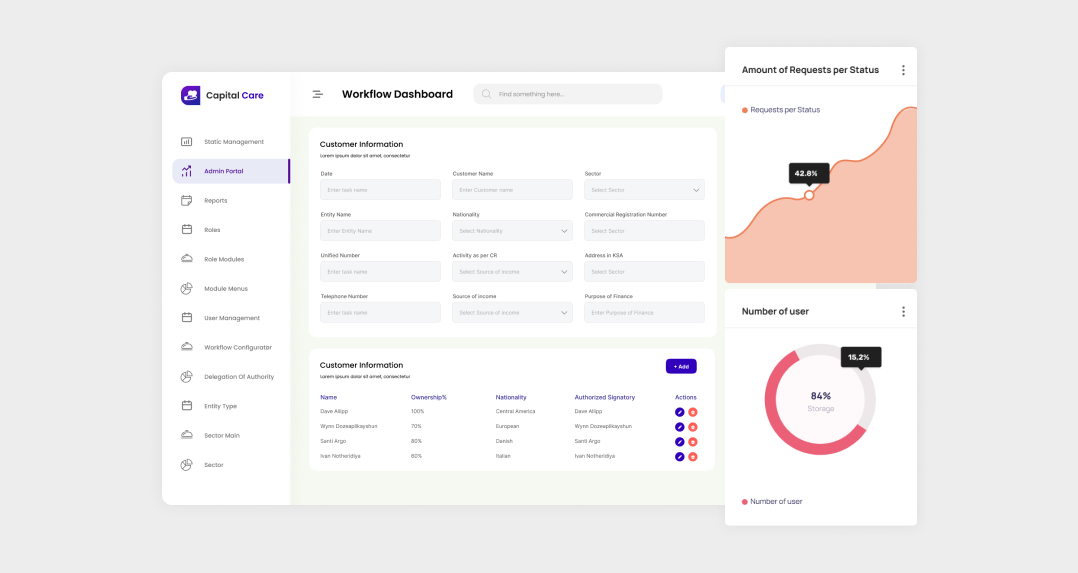

- Dashboard and Reporting: Provides a centralised dashboard for bank staff members to monitor and manage loan applications—customizable reports for performance analysis.

Result of Loan Tracking Software:

Implementing a new credit loan tracking system has increased efficiency as the streamlined process reduces the time of loan application by almost 40%. Customers are more satisfied as it provides a hassle-free application process. Adding to improved efficiency and customer satisfaction, loan management software also helps reduce errors and operational costs. This allowed the bank to stay at the top of the financial industry and better serve its customers in real time.

Technologies and Tools

- Frontend: CSS, HTML, Javascript, Jquery

- Backend: Asp.Net MVC, Soap API

- Database: SQL Server

- Other Technology used: XPO

Interested in Developing A Similar Loan Tracking Software?

Our consultants are ready to hear your ideas. Request a free consultation with our software & app experts and transform it into a digital reality.